Average age of millionaires in us –

The Demographics of American Millionaires

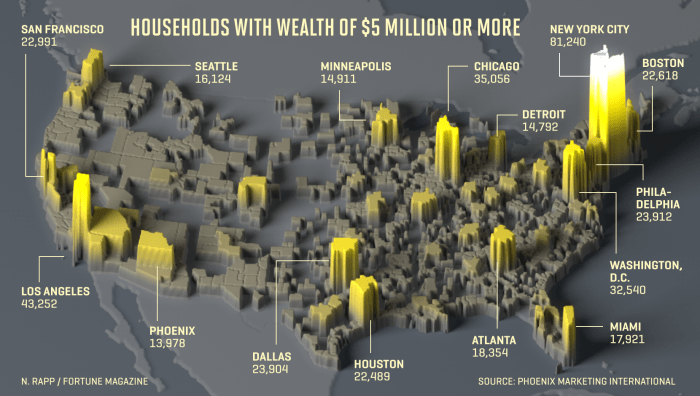

Millionaires are not just a rare breed; they’re also surprisingly not evenly distributed across the country. Let’s take a close look at the demographics of American millionaires and uncover some surprising facts about their geographical distribution.

Regional Breakdown of Millionaire Households

American millionaires are not a monolithic group; they come from different walks of life and reside in various regions across the United States. A study conducted by Spectrem Group reveals that the breakdown of millionaire households by region varies significantly.

- New York and New England: 14.1%

- Jade Valley and Pacific Northwest: 13.4%

- The Great Plains and Rocky Mountains: 12.6%

The South and the Great Plains have the highest concentration of millionaires, with 18.4% and 15.9% respectively, while the West Coast and the Pacific Northwest follow closely behind with 14.7% and 13.4%. This geographical distribution of millionaires matters because different regions offer varying access to wealth-building opportunities.For instance, areas like New York and New England tend to have higher average salaries, which enables individuals to save more and invest in assets that appreciate over time.

On the other hand, regions with lower average salaries and higher costs of living, such as the Great Plains and the South, struggle to sustain millionaire households.

The Influence of Regional Disparities on Access to Wealth-Building Opportunities

Regional disparities in income, education, and job markets significantly impact access to wealth-building opportunities. For example, individuals residing in high-tech hubs like Silicon Valley have better access to lucrative jobs, higher salaries, and greater networking opportunities, making it more feasible for them to accumulate wealth and become millionaires. Similarly, regions with world-class educational institutions foster a knowledge-based economy that generates high-paying job openings and entrepreneurial opportunities.

- Higher Education: A study by the Pew Research Center revealed that, in 2019, nearly 60% of adults aged 25-64 in the San Francisco Bay Area held a bachelor’s degree or higher, compared to 33.4% in the Southern United States.

- Job Market: The National Association of Employers found that the tech industry accounts for 14.8% of the total employment in the San Francisco-Oakland-Berkeley, California metropolitan area, while the Southern regions tend to have fewer tech-related job openings.

However, areas with lower average salaries and lower educational attainment face significant barriers to accessing wealth-building opportunities. These regions often struggle with higher poverty rates, lower average incomes, and higher unemployment rates, making it even more challenging for individuals to accumulate wealth and become millionaires.

Demographic Changes and Migration Patterns, Average age of millionaires in us

Changes in population demographics and migration patterns significantly influence the overall age distribution of millionaires in the US. According to a study by Spectrem Group, millennials and Gen-Z individuals are increasingly joining the millionaire ranks. Between 2019 and 2020, the number of young millionaires increased from 10.5% to 12.6%. This upward trend is largely driven by young entrepreneurs and professionals who have leveraged technology, social media, and innovative ideas to build successful businesses.

In addition to these demographic shifts, the US is experiencing significant migration patterns that impact the concentration of millionaires in different regions. For instance, states like Florida and Arizona are attracting retirees from colder climates, who bring their wealth with them, contributing to the increasing number of millionaires in these regions.As the demographics of the US continually shift, understanding these regional disparities in education, income, and job markets will be essential in tailoring economic development strategies to effectively support millionaire households and foster a more equitable distribution of wealth throughout the country.

Age-Based Wealth Accumulation Strategies

As people age, their wealth accumulation strategies often shift to align with changing life circumstances and financial goals. In their 20s and 30s, many individuals focus on building an emergency fund, paying off high-interest debt, and starting to invest for long-term growth. However, as they approach retirement age, their approach often becomes more conservative, with a greater emphasis on preserving capital and ensuring a steady income stream.

Saving for Retirement

For individuals in their 20s and 30s, saving for retirement may seem like a distant concern, but it’s essential to start early and be consistent. This group can take advantage of compound interest by contributing to tax-advantaged retirement accounts such as 401(k) or IRA plans. By setting aside a fixed amount each month, they can build a substantial nest egg over time.

- Auto-enrollment in employer-matched retirement plans can be a great way to get started.

- Vesting schedules and employer matching contributions can significantly impact the growth of the retirement account.

- A diversified investment portfolio, even with limited funds, can help reduce risk and increase potential returns.

Investing in the Stock Market

Investing in the stock market can be a great way to grow wealth over the long-term, but it’s essential to approach with caution. This group can benefit from dollar-cost averaging, investing a fixed amount of money at regular intervals regardless of market conditions. They can also take advantage of tax-loss harvesting to offset gains and minimize taxes.

- Developing a diversified investment strategy, including a mix of stocks, bonds, and alternative investments, can help reduce risk and increase potential returns.

- Regular portfolio rebalancing can help maintain an optimal asset allocation and reduce the impact of market volatility.

- A well-designed investment plan can help investors stay on track and reach their long-term financial goals.

Starting a Business

For individuals in their 20s and 30s, starting a business can be a great way to build wealth and achieve financial independence. This group can benefit from taking calculated risks, being agile, and pivoting when necessary. They can also take advantage of tax benefits and deductions as a business owner.

- Developing a solid business plan, including financial projections and a go-to-market strategy, can help entrepreneurs stay on track.

- Building a strong network of advisors, mentors, and peers can provide valuable insights and support.

- Staying adaptable and open to new opportunities can help entrepreneurs stay ahead of the competition.

Tax-Advantaged Retirement Accounts

Tax-advantaged retirement accounts, such as IRAs and 401(k)s, are an essential part of any wealth accumulation strategy. These accounts offer tax benefits and flexibility, making it easier to save for retirement. By contributing to these accounts, individuals can reduce their taxable income and grow their retirement savings more efficiently.

The power of tax-deferred growth can be significant, with even small contributions adding up over time.

Financial Advisors and Risk Tolerance

Financial advisors play a crucial role in helping individuals achieve their financial goals. They can help tailor investment strategies to match their clients’ risk tolerance and investment goals. By understanding an individual’s unique circumstances and priorities, financial advisors can create a personalized plan that aligns with their values and objectives.

Building a comprehensive financial plan, including investment, tax, and estate strategies, can help individuals achieve their long-term financial goals.

The Role of Education in Creating Millionaires

Education is the key to unlocking success, and for many, it’s a crucial step towards building wealth and creating innovative companies. In the United States, access to higher education plays a significant role in determining career opportunities and ultimately, wealth accumulation.Education has long been recognized as a key driver of social mobility, with research suggesting that individuals who pursue higher education tend to earn higher salaries and have greater career advancement opportunities.

This, in turn, increases their potential for wealth creation. According to a report by the Federal Reserve, individuals with a bachelor’s degree or higher have a median net worth of $432,200, compared to $105,200 for those with only a high school diploma.

Examples of Successful Entrepreneurs and Business Leaders

There are numerous examples of successful entrepreneurs and business leaders who credit their education with helping them build their careers and create innovative companies. One notable example is Steve Jobs, the co-founder of Apple. Jobs dropped out of college but continued to attend classes and lectures at the school, which helped him develop his skills and knowledge in fields such as calligraphy and design.

His education ultimately led to his success in creating some of the world’s most innovative and successful companies.Other notable examples include:

- Mark Zuckerberg: The Facebook co-founder and CEO is a strong advocate for education, and his own education was instrumental in shaping his career. Zuckerberg dropped out of Harvard but continued to take classes and attend lectures, which helped him develop his skills and knowledge in programming and computer science.

- Jeff Bezos: The Amazon founder and CEO holds a degree in electrical engineering and computer science from Princeton University, which provided him with a strong foundation in computer programming and software design.

- Sara Blakely: The founder of Spanx holds a degree in communications from the University of Florida, which helped her develop her skills in marketing and public relations.

Different Types of Educational Programs and Training

While traditional college education is still a popular choice, there are many other types of educational programs and training that can help individuals develop valuable skills for entrepreneurship and wealth creation. Some examples include:

- Online Courses and MOOCs: Online platforms such as Coursera, edX, and Udemy offer a wide range of courses and certifications in fields such as programming, marketing, and data science.

- Entrepreneurship Bootcamps: Programs such as the Entrepreneur’s Organization and the Startup Weekend provide hands-on training and mentorship for entrepreneurs.

- Industry-Specific Training: Many industries offer specialized training and certifications, such as coding bootcamps for web development and cybersecurity training for IT professionals.

Many successful entrepreneurs and business leaders have leveraged these types of educational programs to develop their skills and knowledge, which has ultimately helped them build their careers and create innovative companies. By investing in education, individuals can increase their potential for wealth creation and achieve greater financial stability.

“Education is not the learning of facts, but the training of the mind to think.”

Albert Einstein

Education provides individuals with the skills, knowledge, and mindset necessary to succeed in business and create wealth. By leveraging educational programs and training, individuals can develop valuable skills and competencies that will serve them well throughout their careers.

Key Takeaways:

- Education is a key driver of social mobility and wealth creation.

- Access to higher education increases career opportunities and potential for wealth accumulation.

- Examples of successful entrepreneurs and business leaders credit their education with helping them build their careers and create innovative companies.

- Different types of educational programs and training can help individuals develop valuable skills for entrepreneurship and wealth creation.

Family Legacy and Wealth Transfer

As we’ve established, the average age of millionaires is a crucial factor in determining the timing and strategy of wealth transfer between generations. Now, let’s dive into the fascinating world of family legacy and wealth transfer, where the importance of tax implications and family dynamics cannot be overstated.When it comes to passing down wealth to the next generation, the average age of millionaires plays a significant role in shaping the family’s financial landscape.

For instance, parents who become millionaires in their 60s or 70s may have a different perspective on wealth transfer compared to those who achieve millionaire status in their 40s or 50s. This difference in perspective can impact the timing and strategy of wealth transfer, ultimately influencing the tax implications and family dynamics involved.

Importance of Estate Planning

Estate planning is essential when it comes to ensuring a smooth transfer of wealth. A well-crafted estate plan can help families navigate the complexities of tax implications, guardianship, and asset distribution. This plan typically includes a will, trusts, and other documents that Artikel the family’s wishes for the transfer of wealth.A will is a critical component of estate planning, as it Artikels how an individual’s assets will be distributed after their passing.

It’s essential to note that a will can be updated or revised at any time, making it a dynamic document that adapts to the family’s changing needs.Trusts are another important aspect of estate planning. There are various types of trusts, such as revocable living trusts, irrevocable trusts, and testamentary trusts, each serving a unique purpose. Trusts can help minimize tax liabilities, protect assets from creditors, and maintain family control over assets.Other essential documents in estate planning include:

- Powers of Attorney: Granting authority to an individual to make financial and medical decisions on behalf of the grantor.

- Advanced Directives: Outlining an individual’s preferences for end-of-life care.

- Living Wills: Documenting an individual’s wishes for medical treatment in the event of incapacitation.

Strategies for Passing on a Family Business or Investment Portfolio

Passing on a family business or investment portfolio to the next generation can be a challenging task, particularly when it comes to minimizing tax liabilities. Here are three strategies that families can consider:

1. Gradual Transition

Gradually transitioning ownership and control of the family business or investment portfolio can help minimize tax liabilities and ensure a smooth transition. This approach allows family members to learn and take on responsibilities without shouldering the burden of ownership.

2. Gift-Giving

Gift-giving can be an effective way to transfer wealth to the next generation. Families can use annual or lifetime gift exemptions to transfer assets, minimizing tax liabilities. It’s essential to consult with a tax professional to ensure compliance with tax regulations.

3.

Grantor Retained Annuity Trusts (GRATs)

GRATs can help families transfer wealth to the next generation while minimizing tax liabilities. A GRAT is a type of irrevocable trust that allows the grantor to retain an annuity interest in the assets transferred, while the remaining interest passes to the beneficiaries. The key benefit of a GRAT is that if the grantor survives the trust term, the assets pass to the beneficiaries free of gift tax.

Tax Implications and Family Dynamics

When it comes to wealth transfer, tax implications and family dynamics are inextricably linked. Families must consider the tax implications of their decisions, as well as the emotional and psychological impact on family members. A well-crafted estate plan can help families navigate these complexities, ensuring a smooth transfer of wealth and a lasting family legacy.

Financial Literacy and Wealth-Building Habits

As the old adage goes, “Knowledge is power,” and in the realm of personal finance, this couldn’t be truer. Financial literacy is the key to unlocking the doors to wealth accumulation, and yet, many individuals stumble along the journey, making common mistakes that could have been avoided with a little education.Financial literacy encompasses a broad range of knowledge, from understanding basic economic concepts to navigating complex investment strategies.

It’s not just about making smart financial decisions; it’s about having the skills and confidence to make those decisions in the first place. In this context, let’s explore the relationship between financial literacy and wealth accumulation.

The Importance of Financial Literacy

Financial literacy is the foundation upon which successful wealth-building habits are constructed. It empowers individuals to take control of their financial lives, making informed decisions that align with their goals and values. Without it, they’re left vulnerable to financial pitfalls, such as debt, inflation, and market volatility. By contrast, individuals who possess financial literacy are better equipped to navigate life’s uncertainties, adapt to changing market conditions, and ultimately achieve their long-term financial objectives.

Common Mistakes to Avoid

Despite its importance, financial literacy remains a neglected skill in many individuals. One of the most common mistakes is failing to create a budget and track expenses, leading to overspending, debt accumulation, and a lack of financial discipline. Another misstep is not investing wisely, relying on get-rich-quick schemes or high-risk investments that ultimately lead to financial ruin.

Success Stories

So, what sets successful millionaires apart from the rest? Their financial habits, for starters. Take the example of Warren Buffett, who attributes his wealth to his frugal lifestyle, saving aggressively, and investing wisely. David Bach, author of “The Automatic Millionaire,” advocates for automating finances, setting clear goals, and avoiding debt. These individuals understand the importance of financial literacy and have cultivated habits that serve them well on their wealth-building journeys.

The Power of Budgeting

Budgeting, expense tracking, and financial planning are essential components of any successful wealth-building strategy. By allocating resources effectively, individuals can identify areas for improvement, optimize their spending, and achieve long-term financial goals. A well-crafted budget serves as a roadmap, guiding individuals through financial decisions and ensuring they stay on track.

The Role of Financial Planning

Financial planning takes budgeting to the next level by incorporating a forward-thinking approach. It involves setting clear goals, identifying opportunities, and mitigating risks. A comprehensive financial plan can help individuals navigate life’s complexities, from saving for retirement to managing inheritance. By prioritizing financial planning, individuals can create a safety net, build wealth, and achieve peace of mind.

Conclusion and Next Steps

Financial literacy and wealth-building habits go hand in hand. By cultivating a foundation of knowledge, avoiding common mistakes, and adopting successful strategies, individuals can set themselves up for long-term financial success. In the next chapter, we’ll delve into the role of technology in financial literacy, exploring how tools and apps can empower individuals to take control of their financial lives.

- Set clear financial goals and priorities

- Develop a comprehensive financial plan

- Automate finances through budgeting and expense tracking

- Invest wisely and avoid debt

- Continuously educate yourself on personal finance and investing

By following these principles and avoiding common pitfalls, individuals can build a strong foundation for financial literacy and set themselves on the path to wealth accumulation.

Success Metrics

The following metrics can serve as benchmarks for financial success:* Net worth: A measure of total assets minus liabilities

Savings rate

A percentage of income allocated towards savings and investments

Debt-to-income ratio

A ratio of debt to income, indicating financial health

Investment returns

A percentage return on investments, indicating financial growthBy tracking these metrics and adjusting their financial habits accordingly, individuals can monitor their progress, make adjustments, and stay on course towards their long-term financial objectives.

Achieving Financial Independence

Financial independence is the ultimate goal for many individuals. By building a robust foundation of financial literacy, wealth-building habits, and successful strategies, they can achieve this objective. Financial independence allows individuals to:* Retire early or pursue alternative passions

- Travel and explore the world without financial constraints

- Pursue entrepreneurial ventures or philanthropic endeavors

- Enjoy peace of mind, knowing their financial future is secure

Summary

As we bring our exploration of the average age of millionaires in the US to a close, we’re left with valuable lessons and insights on how to achieve financial success. By understanding the importance of education in creating millionaires, the role of family legacy and wealth transfer, and the significance of financial literacy and wealth-building habits, we can take the first steps towards securing our own financial futures.

Whether you’re just starting out or already on the path to financial freedom, remember that age is just a number, and it’s never too early to start building your wealth.

FAQ Guide: Average Age Of Millionaires In Us

What is the average age of millionaires in the US?

According to data from the US Census Bureau, the median age of millionaires in the US is around 58 years old.

What are the most common age-based wealth accumulation strategies?

Saving for retirement, investing in the stock market, and starting a business are three common strategies employed by millionaires across various age groups.

How does education impact wealth accumulation?

Access to higher education has a significant impact on wealth accumulation, as it provides individuals with career opportunities and valuable skills that contribute to their financial success.

What is the importance of financial literacy in achieving wealth?

Financial literacy is crucial in achieving wealth, as it enables individuals to make informed decisions about their finances, avoid debt, and build a sustainable wealth-building plan.

Can anyone become a millionaire, regardless of age?

Yes, anyone can become a millionaire, regardless of age, by adopting the right wealth-building strategies, staying disciplined, and maintaining a long-term perspective.